Internal Revenue Service

Fairness in Taxes: How Taxes Affect Us

High schoolers are able to compare the effects of the following, using income as a measure of ability to pay: a progressive tax, a regressive tas, and a proportional tax. They explain how a mixture of regressive and progressive taxes...

Internal Revenue Service

Module 1: Payroll Taxes and Federal Income Tax Withholding

Young scholars complete lessons and worksheet to identify the different types and uses of payroll taxes. They examine how federal income taxes are used, determine the difference between gross and net pay, and determine how employers...

Internal Revenue Service

Understanding the IRS: The IRS Yesterday and Today

Pupils explain why the Internal Revenue Service was instituted, how it functions, how it has changed over the years, and the ways it helps taxpayers today.

Internal Revenue Service

Irs: 1040 Ez [Pdf]

This site provides help with as well as an explanation of the IRS tax form, 1040EZ.

Internal Revenue Service

Irs: Understanding Taxes

The teacher companion to understanding taxes that includes a resource list, lesson plans, and educational standard. The lesson plans discuss how to explain tax theory, applications, and history in the classroom.

Internal Revenue Service

Irs: Module 1: Payroll Taxes and Federal Income Tax Withholding

A tax tutorial that will cover payroll taxes, income tax withholding from employees' pay, and how to complete form W-4.

Internal Revenue Service

Irs: Tax Tutorial: Module 2: Wage and Tip Income

Do you understand how your tip income is taxed? This tutorial will explore the taxation of wages, salaries, bonuses, and tips.

Internal Revenue Service

Irs: Tax Tutorial: Module 3: Interest Income

Learn about interest income and what income is considered tax exempt in this module.

Internal Revenue Service

Irs: Tax Tutorial: Module 4: Dependents

Understand how dependents are declared for taxes in this module.

Internal Revenue Service

Irs: Tax Tutorial: Module 5: Filing Status

This module reviews over the filling statuses that taxpayers may list when filling their taxes.

Internal Revenue Service

Irs: Tax Tutorial: Module 6: Exemptions

Learn the difference between a personal exemption and a dependency exemption in this tax tutorial.

Internal Revenue Service

Irs: Tax Tutorial: Module 7: Standard Deduction

Learn about the standard deduction a single person may take on their income taxes with this tutorial.

Internal Revenue Service

Irs: Tax Tutorial: Claiming Child Tax Credit and Additional Child Tax Credit

This tutorial will help you understand how a child tax credit is claimed on taxes.

Internal Revenue Service

Irs: Tax Tutorial: Module 9: Tax Credit for Child and Dependent Care Expenses

Learn the requirements for claiming the child care tax credit in this tax tutorial.

Internal Revenue Service

Irs: Tax Tutorial: Module 10: Education Credits

A learning module exploring how education credits can be applied to income taxes.

Internal Revenue Service

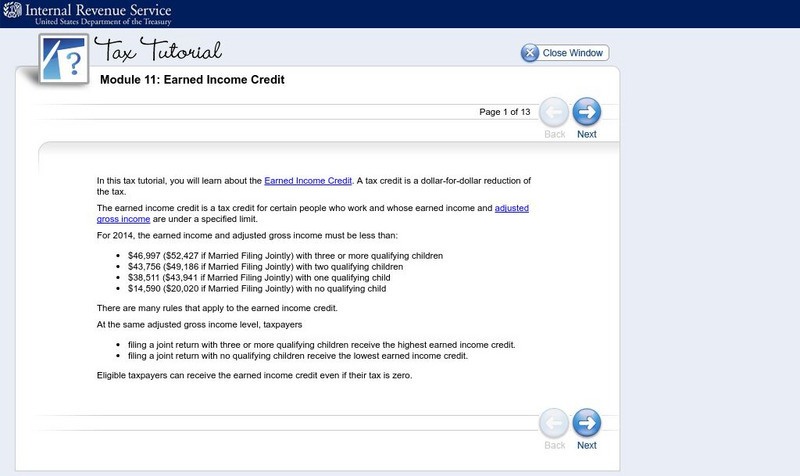

Irs: Tax Tutorial: Module 11: Earned Income Credit

This tax module explores what the earned income credit is and how taxpayers qualify for the credit.

Internal Revenue Service

Irs: Tax Tutorial: Module 12: Refund, Amount Due and Recordkeeping

Learn about how refunds are processed in a tax return with this module.

Internal Revenue Service

Irs: Tax Tutorial: Module 14: Self Employment Income and Self Employment Tax

This tax tutorial focuses on when self-employment tax has to be paid as income tax.

Internal Revenue Service

Irs: Tax Tutorial: Module 13: Electronic Tax Return Preparation and Transmission

This tutorial explores e-filing your income taxes.

Internal Revenue Service

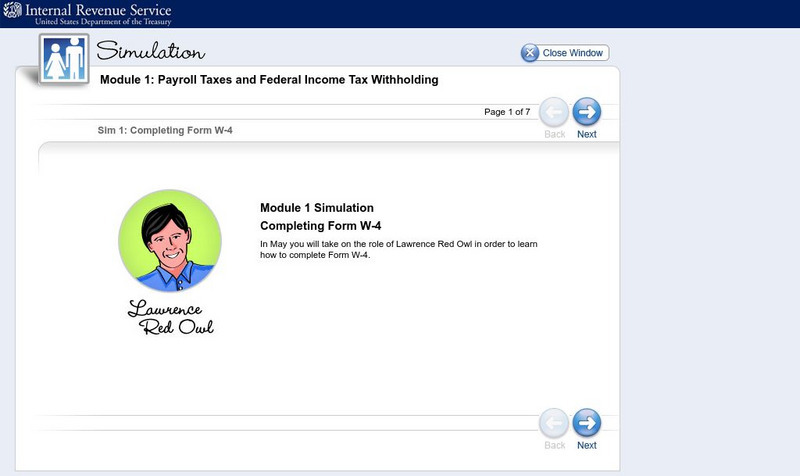

Irs: Completing a W 4

In May you will take on the role of Lawrence Red Owl in order to learn how to complete Form W-4.

Internal Revenue Service

Irs: Payroll Taxes and Federal Income Tax Withholding

Employers withhold taxes from employees' pay. Gross pay is the amount the employee earns. Net pay, or take-home pay, is the amount the employee receives after deductions.

Internal Revenue Service

Irs: Interest Income

This lesson plan will help students understand that most interest income is taxable.

Internal Revenue Service

Irs: Filing Status

This lesson plan will help students understand how filing status affects tax rates and how to choose the appropriate filing status for the taxpayer.

Internal Revenue Service

Irs: Self Employment Income and the Self Employment Tax Lesson Plan

This lesson plan will help learners understand self-employment income and the self-employment tax.

![Irs: 1040 Ez [Pdf] eBook Irs: 1040 Ez [Pdf] eBook](https://d15y2dacu3jp90.cloudfront.net/images/attachment_defaults/resource/large/FPO-knovation.png)