Other

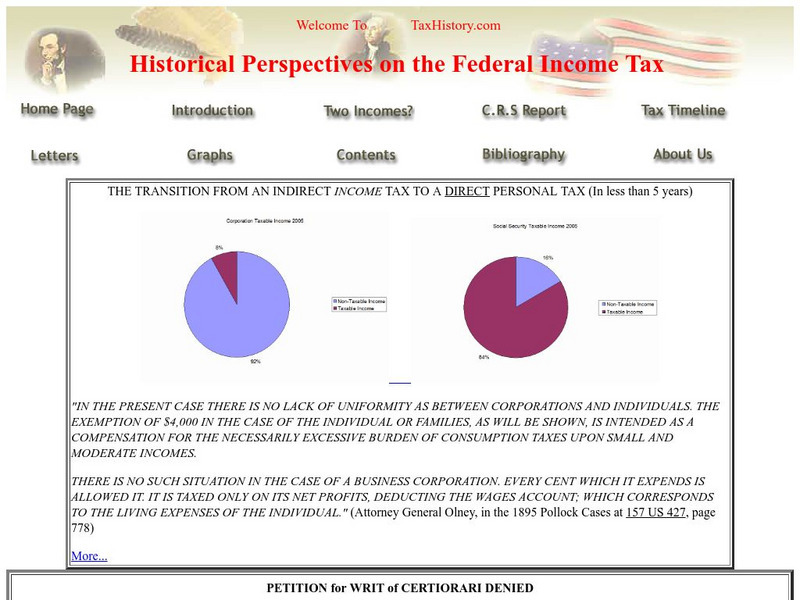

Tax history.com Federal Income Tax History

TaxHistory.com provides a detailed look at the development and history of the federal income tax. Content addresses the roots of the federal income tax with the 1894 Income Tax Act, the reasoning behind the 16th amendment, the two uses...

Internal Revenue Service

Irs: Income Tax Issues Lesson Plan

This lesson plan will help students understand how and why a federal income tax was implemented by Congress during the Civil War and in 1913.

US Government Publishing Office

U.s. Government Publishing Office: Constitution of the United States of America: 16th Amendment Income Tax [Pdf]

Read this text of the 16th Amendment, followed by the history of the Amendment and an analysis. (PDF)

Internal Revenue Service

Internal Revenue Service: Frequently Asked Questions and Answers

Hundreds of questions about taxes are answered here. FAQs are sorted by category, subcategory, and keyword.

Harp Week

Harp Week: The Presidential Elections: 1896 Mc Kinley v. Bryan

A three-page look at the campaign and election of 1896 in which William McKinley, the Republican candidate, ran against Wiliam Jennings Bryan, the Democratic candidate. Read about the nominating conventions, the platforms, and the...

Thomson Reuters

Find Law: u.s. Constitution: Annotation 1: Sixteenth Amendment

This article provides the background of the 16th Amendment, which established a federal income tax.

US Department of the Treasury

Secretaries of the Treasury: William G. Mc Adoo

William McAdoo's tenure as Secretary of the Treasury under Woodrow Wilson is overviewed on the official site of the U.S. Department of the Treasury. Read about the accomplishments of the Treasury Department under McAdoo including the...

Wolters Kluwer

Business Owner's Toolkit: Determing Which Payroll Taxes Apply to Your Employees

This resource contains pertinent information regarding withholding exemptions for employees and how the tax is withheld. Links are also provided for additional information on related subjects.

![U.s. Government Publishing Office: Constitution of the United States of America: 16th Amendment Income Tax [Pdf] Primary U.s. Government Publishing Office: Constitution of the United States of America: 16th Amendment Income Tax [Pdf] Primary](https://d15y2dacu3jp90.cloudfront.net/images/attachment_defaults/resource/large/FPO-knovation.png)