Curated by

ACT

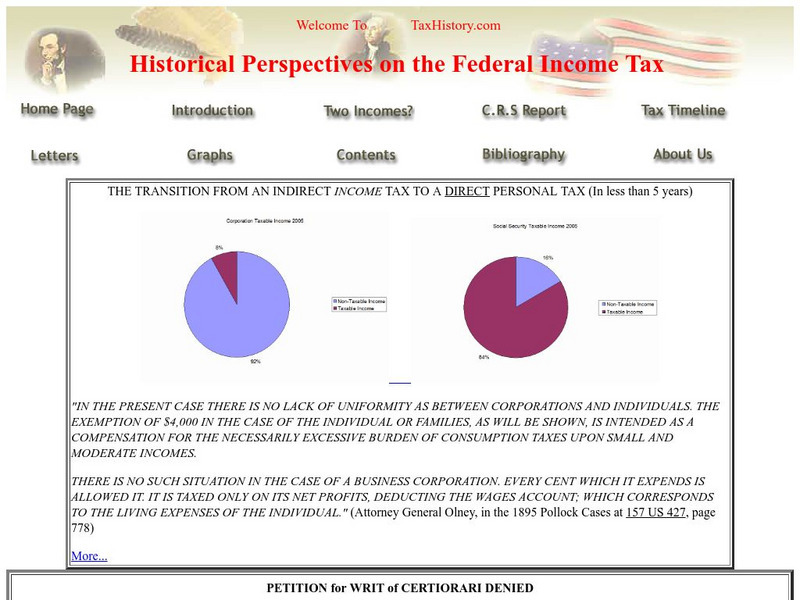

TaxHistory.com provides a detailed look at the development and history of the federal income tax. Content addresses the roots of the federal income tax with the 1894 Income Tax Act, the reasoning behind the 16th amendment, the two uses of the word "Income," applications of the tax today, and much more.

3 Views

0 Downloads

Concepts

Additional Tags

1894 income tax act, broading of the taxpayer base, capitation and other direct taxes, enforced savings, federal income tax history, federal reserve, historical perspectives on the federal income tax, individual income tax of 1944, internal revenue code 1939, internal revenue code of 1954, leagal interpetations, national debt, net-income, no cost basis, petition of redress of grievance, public salary tax act, public salary tax act of 1939, revenue act of 1940, revenue act of 1941, revenue act of 1943, revenue act of 1944, revenue acts summary, revenue bill of 1940, revenue bill of 1942, sixteenth amendment, social security act, social security trust accounts, social welfare and its cost, tax history, tax reduction correspondence, tax timeline, two income taxes, uniformity, victory tax act of 1942, c.r.s. report, crs report to congress, capitation, or other direct, tax, duties, imposts, and excises, life, liberty, and persuit of happiness, federal income tax

Classroom Considerations

- This resource is only available on an unencrypted HTTP website.It should be fine for general use, but don’t use it to share any personally identifiable information