Other

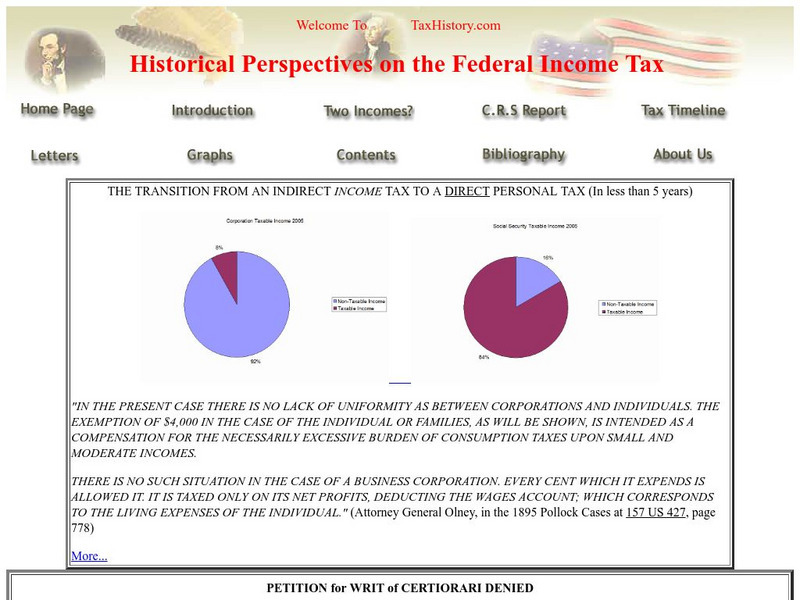

Tax history.com Federal Income Tax History

TaxHistory.com provides a detailed look at the development and history of the federal income tax. Content addresses the roots of the federal income tax with the 1894 Income Tax Act, the reasoning behind the 16th amendment, the two uses...

Internal Revenue Service

Irs: Income Tax Issues Lesson Plan

This lesson plan will help students understand how and why a federal income tax was implemented by Congress during the Civil War and in 1913.

Cornell University

Cornell University: Law School: Income Tax Law: An Overview

A collection of resources for understanding income tax law, including its roots in the Constitution, federal and state statutes and regulations, judicial decisions, and links to the websites of government and tax agencies.

Scholastic

Scholastic: The Progresssive Era

This Grolier On-line Encyclopedia article hits the main points of the Progressive Era stretching from the 1890s until just after the end of World War I.

Library of Congress

Loc: Today in History: March 8: Susan B. Anthony Makes a Statement

This article details Susan B. Anthony's speech to the Judiciary Committee of the House of Representatives on March 8, 1884 about women's right to vote. Includes a portrait of the activist and quotes from her speech.

Thomson Reuters

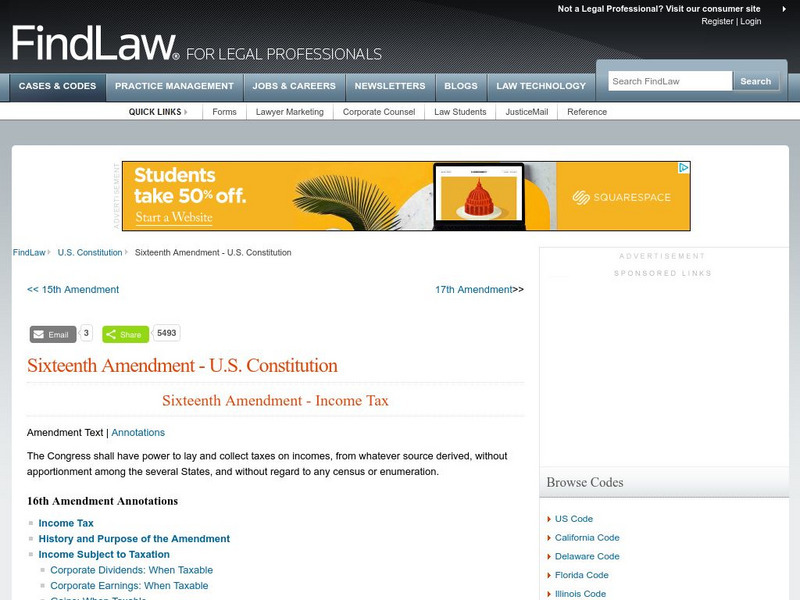

Find Law: u.s. Constitution: Annotation 1: Sixteenth Amendment

This article provides the background of the 16th Amendment, which established a federal income tax.

Thomson Reuters

Find Law: u.s. Constitution: Sixteenth Amendment

This resource provides a detailed overview of the 16th amendment to the U.S. Constitution. Content includes a focus on income tax, the history and purpose of the amendment, and the incomes subject to taxation.