Curated OER

Calculating Sales Tax

Observe and demonstrate how to calculate state sales taxes. Learners create a sales tax chart by calculating the sales tax amount and tax inclusive retail price for school store items, then calculate the subtotals, sales tax amounts, and...

Virginia Department of Education

Sales Tax and Tip

Don't forget to tip your server. Future consumers learn how to calculate sales taxes and tips. Pairs use actual restaurant menus to create an order and determine the total bill, including taxes and tips.

Curated OER

Completing Simple Tax Forms

Twelfth graders practice filling out IRS 1040 EZ forms. They discuss various ways people pay taxes. They assess the importance of W-2 forms and apply skills using the IRS tax table to compute how much money is owed or returned.

Curated OER

Taxes and Sales

Collaborative discussions around this retail store problem will be taxing. Calculating discount and tax and the order of the operations are used to motivate an opportunity for learners to make a convincing argument using algebraic...

EngageNY

Federal Income Tax

Introduce your class to the federal tax system through an algebraic lens. This resource asks pupils to examine the variable structure of the tax system based on income. Young accountants use equations, expressions, and inequalities to...

Curated OER

Sales Tax and Discounts

Middle schoolers explore the concept of sales tax and discounts. In this sales tax and discounts lesson, students pretend to gamble in groups to win fake money. Middle schoolers must tax their winnings. Students collect receipts. Middle...

Curated OER

Module 12-Self-Employment Income and the Self-Employment Tax

Students explain self-employment income and the self-employment tax. They distinguish between an employee and an independent contractor and explain how to compute and report self-employment profit.

Curated OER

Computing Costs

Seventh graders calculate the out-of-pocket money needed to purchase a discounted item taxed at a certain percentage of sales tax.

Illustrative Mathematics

Tax and Tip

Finding out how to calculate tax and tip is a valuable skill that all young adults should be able to do without a calculator. Learners are given a bill and asked to calculate the tax, tip, and total amount. Calculations can be exact or...

Federal Reserve Bank

“W” Is for Wages, W-4 and W-2

Don't let your young adults get lost in the alphabet soup of their paychecks and federal income taxes. Using sample pay stubs and reproductions of government forms, your class members will identify the purpose of such forms as a W-4 and...

The New York Times

Understanding the Mathematics of the Fiscal Cliff

What exactly is the fiscal cliff? What are the effects of changing income tax rates and payroll tax rates? Your learners will begin by reading news articles and examining graphs illustrating the "Bush tax cuts" of 2001 and 2003. They...

Curated OER

Money Math: Lessons for Life

Students explore money as it applies to salary, paychecks, and taxes. In this essential mathematics instructional activity, students explore how math is used in various careers, how income takes are calculated and other important life...

Curated OER

Government Goods and Services

Fifth graders investigate the connection between taxes and government services. In this economics instructional activity, 5th graders discuss the process and benefits of paying sales and income taxes. Using calculators,...

Curated OER

Sales Spreadsheet

Students use Excel spreadsheets to organize purchases, discounts, sales prices, and sales tax. Students follow step by step instructions and enter formulas as well as use the auto sum feature to calculate required calculations.

Curated OER

Markup, Discount, and Tax (Harder)

In this algebra activity, students calculate prices with taxes and percents attached. They figure the finals price for each problem after they correctly compute the taxes and percent. There are 16 problems on this activity.

Curated OER

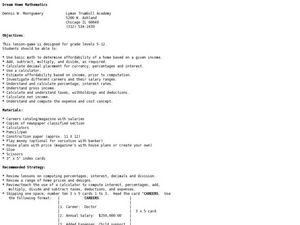

Dream Home Mathematics

Explore the concept of budgeting with sixth graders. They will pick a career on note card made by the teacher. They then use the information on the card such as salary, expenses, and career to create a life for themselves. They also...

Curated OER

Go Figure! Using Percents in the Real World

Sixth graders solve sales tax problems. In this solving sales tax problems lesson, 6th graders find the sales tax on various items. Students are given a list of expenses that a family spent on vacation before taxes. ...

Curated OER

Let's Go Shopping with $500

Third graders use a worksheet to budget a five-hundred dollar shopping spree. They select goods to purchase, figure totals and then calculate discounts and sales tax. They compare results to determine who purchased the most for his or...

Curated OER

Shopping Spree

Students calculate discounts, sale price, and sale tax. In this consumer math lesson plan, students visit mock stores which have items for sale. Students calculate the final prices of items.

Illustrative Mathematics

Discounted Books

Adolescents love to shop, especially when an item is discounted. Here, shoppers only have a set amount of money to spend. Will they be able to make a purchase with the discount and tax added in? Percent discounts can be calculated...

Curated OER

Family Purchases

Learners generate a gift list for their family members making sure the costs remain under budget. They research the cost of items on the internet, calculate sales tax, and determine the total cost for all of the gifts.

Curated OER

CiCi Pizza Problem

In this CiCi's activity, students determine the tax rate for a specified town from given information. They compute the discount rate given for a group of students to eat at the resturant. This one-page activity contains 2...

Noyce Foundation

Sewing

Sew up your unit on operations with decimals using this assessment task. Young mathematicians use given rules to determine the amount of fabric they need to sew a pair of pants. They must also fill in a partially complete bill for...

Curated OER

Percent of Change, Discounted Price, and Total Price

In this percent of change worksheet, students find the percent of increase and the percent of decrease. They compute sales tax and determine the final price. Students also figure the discounted price of an...