Curated OER

Solving Problem Involving Percents- Practice Worksheet

In this middle to high school math worksheet, students practice solving short work problems that involve percents. They solve 12 problems on the page.

Curated OER

Accounting -- Preparing Payroll Records

Students review preparation of payroll records and practice these skills while playing games on the computer. They follow a student outline and complete online activities and quiz.

Curated OER

Government Jeopardy Relay

Students review facts and concepts of the Canadian System of Government using a game format.

Curated OER

Running for Public Office

Young scholars engage in the election process. In this public office instructional activity, students review the election and campaign process then design a campaign for their own selected office election using provided guidelines and...

Curated OER

Census Countdown

Students read and discuss the census and how the census is used by the government. In this census lesson plan, students use the data collected to compare different census's and their outcomes.

Curated OER

Uncle Jed's Barbershop

Fourth graders examine productive resources. In this economics lesson, 4th graders read a book about a man who saves money to buy his own barbershop. After reading, students get into groups to play a game to learn about savings.

Curated OER

Less Than Zero

Students keep track of money. In this money management lesson, students read Less Than Zero by Stuart J. Murphy and manipulate a number line to keep track of spending and borrowing in the story.

Curated OER

What Kind of Santa Claus You Are.

Students use a photograph analysis sheet to analyze primary sources (photographs) of the Great Depression in small groups. They then write a poem about kids in the Depression Era that reflects their comprehension of the period and...

Curated OER

Doctor's Dilemma: Advocacy for Whom?

Students investigate why doctors feel torn between patients and insurance companies. They examine the health care system and how it affects patients. They discuss one's ability to afford health insurance as well.

Curated OER

Payroll Deductions/ Sequential Order of Words in a Sentence.

Students who are adult ESOL learners examine pay stubs and determine how payroll deductions are spent on services and company benefits. While looking at a pay stub they complete a worksheet. They focus on the proper sequence of words in...

Curated OER

Maintaining Employment ESOL

Students discuss how Payroll deductions are used to pay for a variety of government services andncompany benefits. They practice reading a pay stub and writing amounts of money.

Curated OER

Hey, Mom! What's for Breakfast?

Students examine how he world eats breakfast. In this food choices lesson, students work in groups to list breakfast foods and their ingredients and find goods and consumers on the list. The, students use the Internet to complete a...

Curated OER

Money, Money, Honey Bunny!

Students determine the differences between goods and services, and saving and spending. In this economics lesson, students listen to a rhyming story about a bunny with money. They play a matching game with the associated cards and work...

Curated OER

Saving Strawberry Farm

Learners explore U.S. History by analyzing the Great Depression. In this economic instability activity, students read fictitious accounts of a farm dealing with the loss of a Strawberry Farm and discuss the reasons behind the loss....

Curated OER

There's No Business Like Bank Business

Students participate in a role play where they see how a bank works and how interest is paid by having money in the bank. In this bank lesson plan, students operate a bank and learn about saving, accounts, deposits, withdrawals,...

Other

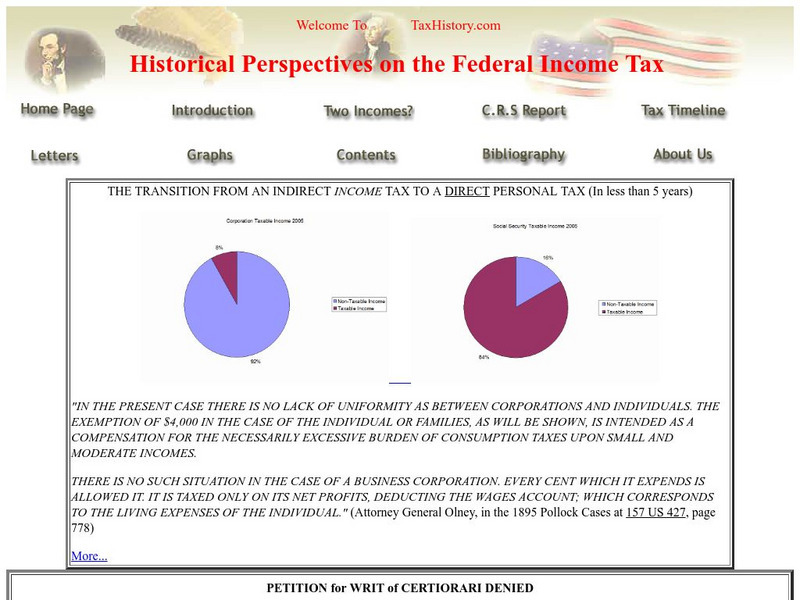

Tax history.com Federal Income Tax History

TaxHistory.com provides a detailed look at the development and history of the federal income tax. Content addresses the roots of the federal income tax with the 1894 Income Tax Act, the reasoning behind the 16th amendment, the two uses...

Internal Revenue Service

Irs: Payroll Taxes and Federal Income Tax Withholding

Payroll taxes include the Social Security tax and the Medicare tax. Social Security taxes provide benefits for retired workers, the disabled, and the dependents of both. The Medicare tax is used to provide medical benefits for certain...

Internal Revenue Service

Irs: Payroll Taxes and Federal Income Tax Withholding Assessment

Answer the following multiple-choice and true/false questions about payroll taxes and federal income tax withholding by clicking on the correct answers. To assess your answers, click the Check My Answers button at the bottom of the page.

Internal Revenue Service

Irs: Earned Income Tax Credit (Eitc)

The IRS provides a collection of articles and factsheets regarding the Earned Income Tax Credit (EITC). Content includes an overview of the EITC, the way to find out if you qualify, information for employers, law changes and more.

Internal Revenue Service

Irs: Payroll Taxes and Federal Income Tax Withholding

Employers withhold taxes from employees' pay. Gross pay is the amount the employee earns. Net pay, or take-home pay, is the amount the employee receives after deductions.

Consumer Financial Protection Bureau

Cfpb: Investigating Payroll Tax and Federal Income Tax Withholding

Students analyze W-4 forms and paystubs in order to better understand payroll taxes and federal income tax withholding.

Internal Revenue Service

Irs: Payroll Taxes and Federal Income Tax Withholding Lesson Plan [Pdf]

This lesson will help students understand the withholding of payroll and income taxes from pay.

Internal Revenue Service

Irs: Payroll Taxes and Federal Income Tax Withholding Lesson Plan

This lesson plan will help learners understand the withholding of payroll and income taxes from pay.

Internal Revenue Service

Irs: Module 1: Payroll Taxes and Federal Income Tax Withholding

A tax tutorial that will cover payroll taxes, income tax withholding from employees' pay, and how to complete form W-4.

Other popular searches

- Federal Income Tax 1040ez

- Federal Income Tax Forms

- Filing Federal Income Tax

- Federal Income Tax 1040ex