Bankrate

Bankrate.com: Taxes

This site explores the basics of taxes including finding your tax bracket, income tax calculator, earned income tax, state taxes, states with no income tax, and capital gains.

Cynthia J. O'Hora

Mrs. O's House: Gas and Diesel Taxes

Students will evaluate whether federal tax on gas and diesel fuels should stay the same or increase based on data researched and write persuasive letters to their local papers and legislators urging them to take their stance.

Wikimedia

Wikipedia: Goods and Services Tax (Canada)

An overview of Canada's Goods and Services Tax or GST. Discusses what was affected by the tax and its impact.

Internal Revenue Service

Irs: Payroll Taxes and Federal Income Tax Withholding

Employers withhold taxes from employees' pay. Gross pay is the amount the employee earns. Net pay, or take-home pay, is the amount the employee receives after deductions.

Internal Revenue Service

Irs: Income Tax Facts

This lesson plan will help students understand that taxation involves a compromise of conflicting goals and that people who have the same income may not pay the same amount in taxes.

Next Gen Personal Finance

Next Gen Personal Finance: Taxes

Lessons and activities to teach students about federal taxes.

Other

The Igen Blog: Ultimate Excise Tax Guide Definition, Examples, State vs. Federal

This is a fairly detailed explanation of state and federal excise taxes designed for the layperson, not for tax experts.

The Balance

The Balance: Sin Tax: Definition, Their Pros and Cons, and Whether They Work

Both the federal government and many state governments impose "sin taxes" that tax items and activities which are considered socially harmful. This article explains these taxes and shows how much states and the federal government raise...

Federal Reserve Bank

Federal Reserve Bank of St. Louis: Income Taxes: Who Pays and How Much? [Pdf]

A lesson unit that teaches students all about income tax: what it is, why we have it, how taxes are structured, factors that affect one's tax bracket, and what would happen if the tax structure were changed.

C-SPAN

C Span Classroom: Teaching About Gas Tax

Students use multi-media materials to learn about tax on gas and then participate in classroom deliberations about whether or not the government should raise tax on gas to fund federal highway projects. Includes lesson plans and all...

Lectric Law Library

Lectric Law Library: Understanding the Federal Courts

This document provides an overview of the organization, operation, and administration of the entire federal court system. The article gives information on the federal judicial branch, the state and federal courts, the structure of the...

The Balance

The Balance: Learn About Fica, Social Security, and Medicare Taxes

Without understanding FICA, many high school students who begin working are shocked when they get their first paychecks. This article clearly explains these payroll taxes and what they mean for both employees and employers.

Council for Economic Education

Econ Ed Link: Preparing a 1040 Ez Income Tax Form

Many students in high school or in college have part time jobs and learn the concept of gross pay and net pay. Their employers take out taxes at the federal and state level. This activity takes a common situation and helps students...

Annenberg Foundation

Annenberg Classroom: Federal Taxation

Check out this interactive timeline documenting the history of federal taxation in the United States.

Constitutional Rights Foundation

Constitutional Rights Foundation: Proposed Changes in the Way the Federal Government Operates

Examine amendments made to aid the government in balancing the budget and income tax as well as the debate over term limits.

American Battlefield Trust

American Battlefield Trust: Civil War: The First Income Tax

This site provides an overview of the development of the first national income tax, instituted to fund the Civil War.

Council for Economic Education

Econ Ed Link: Why Cities Provide Tax Breaks

Like the state and federal government, local governments offer tax incentives to businesses to help solve economic and/or environmental problems. For this lesson, students will explore three different cities and determine what incentives...

Texas State Historical Association

Texas State Historical Association: Federal Government [Pdf]

An activity guide where young scholars refer to the Texas Almanac, which is free to download, for information needed to complete assigned tasks. In this lesson, they investigate the role the federal government plays in Texas.

ProProfs

Pro Profs: How Much Do You Know About Taxes?

Find out how much you know about taxes with this quick 5-question quiz.

Other

Entrepreneur: Taxing Matters

This Entrepreneur Magazine article provides "Everything you wanted to know about payroll taxes, and then some," and includes a good explanation of FICA (social security and medicare) withholding.

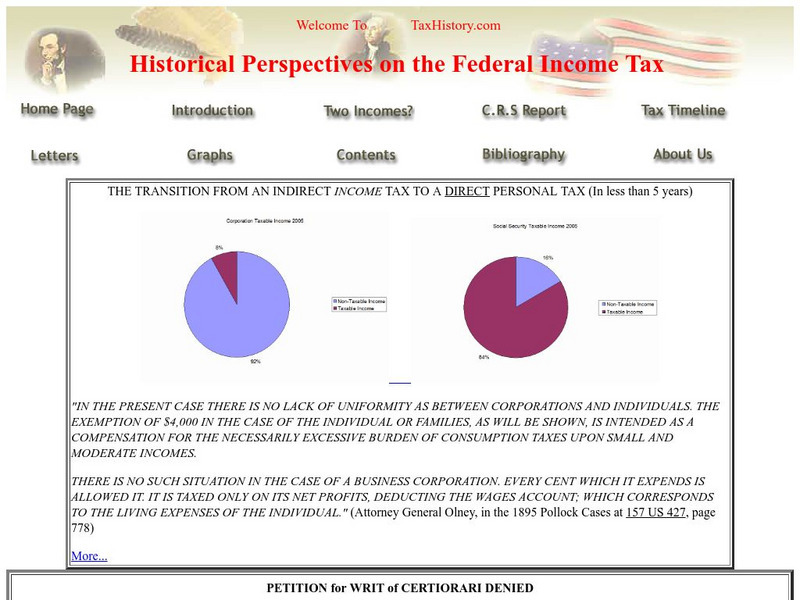

Other

Tax history.com Federal Income Tax History

TaxHistory.com provides a detailed look at the development and history of the federal income tax. Content addresses the roots of the federal income tax with the 1894 Income Tax Act, the reasoning behind the 16th amendment, the two uses...

Internal Revenue Service

Irs: Payroll Taxes and Federal Income Tax Withholding

Payroll taxes include the Social Security tax and the Medicare tax. Social Security taxes provide benefits for retired workers, the disabled, and the dependents of both. The Medicare tax is used to provide medical benefits for certain...

Internal Revenue Service

Irs: Payroll Taxes and Federal Income Tax Withholding Assessment

Answer the following multiple-choice and true/false questions about payroll taxes and federal income tax withholding by clicking on the correct answers. To assess your answers, click the Check My Answers button at the bottom of the page.

Internal Revenue Service

Irs: Payroll Taxes and Federal Income Tax Withholding Lesson Plan [Pdf]

This lesson plan will help students understand the withholding of payroll and income taxes from pay.