Federal Reserve Bank

Income Taxes

Most adults dread April 15 — tax day! Tax preparation can be intimidating even for adults. Build confidence by leading individuals through the process and then give them a scenario to practice. The exercise uses tax vocabulary to give...

Council for Economic Education

Preparing a 1040EZ Income Tax Form

Some of us never feel like we know how to do our taxes! Help scholars understand the process early by using an informative resource. They fill out their own tax forms in a simulation activity and view multiple resources to learn even...

Curated OER

Tax Forms and Deductions

Because many of your older students are probably getting their first jobs, it could be an appropriate time to discuss taxes. This presentation defines deductions, types of taxes, purposes of paying taxes, and the forms required to file...

Federal Reserve Bank

U.S. Income Inequality: It's Not So Bad

What is the difference between a flat tax, progressive tax, tax deduction and transfer payments? Pupils examine the ability-to-pay principle of taxation through discussion, problem solving, and a variety of worksheets on topics from US...

Curated OER

The Five W's of Tax Day

Use April 15th to teach your students the fundamentals of the American federal tax system.

Curated OER

Preparing a 1040EZ Income Tax Form

What do you do at the end of the year when your W2 arrives? File a tax form! Show learners how they to can fill out a basic 1040EZ tax form and play their part as tax paying citizens. Monetary denominations are provided for filling out...

Visa

Nothing But Net: Understanding Your Take Home Pay

Introduce your young adults to the important understanding that the money they receive from their paychecks is a net amount as a result of deductions from taxes. Other topics covered include federal, state, Medicare and social...

Radford University

Percentages: Lesson 1

Math can be taxing at times. With a short lesson, pupils determine how income tax affects take-home pay. Learners determine their net pay based on tax tables and how adjustments in their gross pay changes the paycheck.

Arizona Department of Education

Be Independent / Life Management Skills

Living independently is about more than managing money. Learn how to manage time, balance responsibilities, and calculate overtime and income with a set of activities about life management skills.

Curated OER

Taxes in U.S. History: Tax Reform in the 1960s and 1980s

Learners explain the content, purpose, and impact of the Tax Reform Acts of 1969 and 1986.

Curated OER

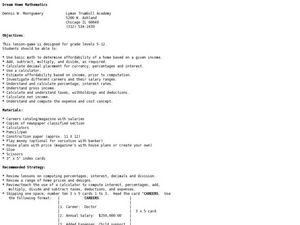

Dream Home Mathematics

Explore the concept of budgeting with sixth graders. They will pick a career on note card made by the teacher. They then use the information on the card such as salary, expenses, and career to create a life for themselves. They also...

Curated OER

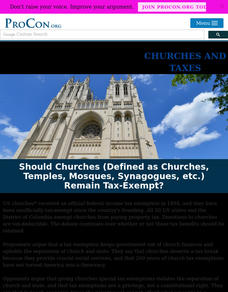

Churches and Taxes

Churches have been tax-exempt since the founding of America, but should they be? Pupils ponder the question as they browse the website in preparation for a class debate or discussion. They research the history of tax-exemption for...

Curated OER

Taxes: Where Does Your Money Go?

Students explore the concept of taxes. In this tax lesson, students investigate types of taxes and deductions taken out of a paycheck before they see it. Students calculate the tax on a given dollar amount. Students discuss 401(k)s...

Curated OER

Financial Literacy - Income and Deductions

Students examine payroll process, determining ones income, deductions taken out of paychecks (taxes, insurance, charitable contributions, retirement), fixed and variable expenses to expect and money management.

Curated OER

Earned Income Credit

Learners distinguish between tax deduction and tax credit, explain how the earned income credit affects the tax liability, apply requirements to claim the earned income credit, and describe factors that determine the amount of the earned...

Curated OER

Module 8-Tax Credit for Child and Dependent Care Expenses

Students explain the tax credit for child and dependent care expenses. They distinguish between a tax deduction and a tax credit. They see how the tax credit for child and dependent care expenses affects the tax liability.

Curated OER

Tax Problem: Percents

In this tax learning exercise, students solve 1 problem about taxes. Students find the federal and state tax on a given amount of money.

Curated OER

Taxes in U.S. History: The Social Security Act of 1935

Students explain the history of the Social Security Act and the FICA tax. They describe what Social Security is and whom it is intended to help. They explain the purpose of the FICA tax.

Curated OER

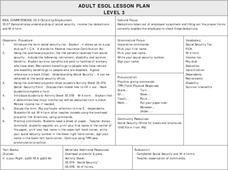

ADULT ESOL LESSON PLAN--Level 3--Obtaining Employment

Pupils examine and view a variety of employment facts/legalities that comes with employment in the United States including social security, income tax deductions and W-4 forms, just to mention a few.

Curated OER

Taxes: Where Does Your Money Go?

Students study taxes and the role that they place in our lives. In this economic lesson plan, students explore the reality of taxes, how they work, why we pay them, where the money goes and how to make the most of the money you pay into...

Curated OER

Taking Taxes

Students discuss the role of taxes and tax deductions in the maintence of community services. A practice W-4 form is completed by students who identify their exemptions. This lesson is intended for students acquiring English.

Curated OER

The Politics Of Taxation

Students explain that taxation involves a compromise of conflicting goals and that lobbyists can influence lawmakers' decisions about taxes. They can explain why people of similar incomes often pay different tax rates and work in teams...

Curated OER

Reading A Pay Stub For Paryroll Deductions

Students identify and explain the various payroll deductions that are taken to pay for a variety of government services and company benefits. This lesson is intended for students acquiring English.

Curated OER

Payroll Deductions/ Sequential Order of Words in a Sentence.

Students who are adult ESOL learners examine pay stubs and determine how payroll deductions are spent on services and company benefits. While looking at a pay stub they complete a worksheet. They focus on the proper sequence of words in...