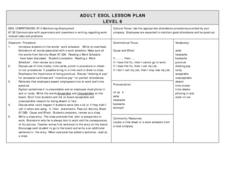

Curated OER

Mueller v. Allen

Students investigate a First Amendment legal case involving religion, education, and reimbursement of tuition payments. They research the background of the cases and its precedents.

Practical Money Skills

Making Money

The first step in managing your money is making money! Learn about ways to find and interview for a job with a thorough lesson plan on personal finances. Kids learn about the ways to earn a paycheck and then manage the funds they receive.

PBS

Where Does Your Paycheck Go?

Upper elementary learners explore the concept of taxes taken out of an employee's paycheck. As they work through this lesson, young mathematicians discover the difference between gross pay and net pay. They also see what types...

Curated OER

Basic Budgeting

Students create a personal budget. In this creating a personal budget lesson, students create a list of 3 necessary things they need to survive. Students rank these things in order of importance and determine their...

Curated OER

Reading A Pay Stub

Students complete the included activity sheet related to reading a pay stub and calculating deductions. Once the activity sheet has been checked, students demonstrate their knowledge of the vocabulary associated with the lesson through...

Curated OER

ESOL 18 Obtaining Employment

Students examine the terms social securtiy tax, social security, retirement and benefits. They respond to different commands about forms needed for employment. They practice filling out Social Security and W-4 forms.

Curated OER

Filing Status

Students examine then discuss the rate at which income is taxed and the five filing statuses. They complete online simulation worksheets then they answer a list of questions.

Curated OER

Maintaining Employment ESOL

Students discuss how Payroll deductions are used to pay for a variety of government services andncompany benefits. They practice reading a pay stub and writing amounts of money.

Visa

Making Money

From evaluating the current employment market to building a resume, pupils are introduced to the wide and varied elements of career planning.

Curated OER

Bookkeeping 101

Students state the important questions that must be answered through the use of expense records. They design and test a method for recording business expenses.

Curated OER

The Artist as Entrepreneur: Is this a Hobby or a Business?

Young scholars discover the IRS codes and criteria for establishing their art activity as a business rather than a hobby. They develop ways to demonstrate that their art activity is actually a business venture as classified by the IRS.

Curated OER

Financial Planning

Students research possible careers. They determine typical starting income for the career. Using collected information, students develop a budget for their starting income. Students consider car payments and research the process of...

Curated OER

The Consumer Price Index: A Measure of Inflation

Students examine inflation over the years and learn to calculate how it changes over time. In this money management instructional activity, students learn how price changes affect their purchasing power, how to come up with strategies...

Curated OER

Decimal Word Problems

In this decimals activity, students solve 10 different word problems that include using decimals. First, they determine the amount of change received from a cashier given a specific amount. Then, students write a decimal representing the...

Curated OER

Scarcity & Choice

In this economics worksheet, students respond to 16 fill and the blank and multiple choice questions about scarcity and choice.

Curated OER

Who Does the Lottery Benefit?

Students investigate the pros and cons of the lottery. In this algebra lesson plan, students use the formulas for permutation and combination to test their arguments about the lottery. They collect data about their argument and plot it...

Curated OER

Making Money

Students consider career options. In this career planning lesson, students practice job interviewing skills, examine payroll checks and discuss employee benefits.

Internal Revenue Service

Irs: Earned Income Tax Credit (Eitc)

The IRS provides a collection of articles and factsheets regarding the Earned Income Tax Credit (EITC). Content includes an overview of the EITC, the way to find out if you qualify, information for employers, law changes and more.

Council for Economic Education

Econ Ed Link: Preparing a 1040 Ez Income Tax Form

Many students in high school or in college have part time jobs and learn the concept of gross pay and net pay. Their employers take out taxes at the federal and state level. This lesson plan takes a common situation and helps students...

Internal Revenue Service

Irs: Payroll Taxes and Federal Income Tax Withholding

Employers withhold taxes from employees' pay. Gross pay is the amount the employee earns. Net pay, or take-home pay, is the amount the employee receives after deductions.

Internal Revenue Service

Irs: Income Tax Facts

This lesson plan will help students understand that taxation involves a compromise of conflicting goals and that people who have the same income may not pay the same amount in taxes.

Internal Revenue Service

Irs: Earned Income Credit Lesson Plans

This lesson plan will help students understand the earned income credit.

Internal Revenue Service

Irs: Tax Credit for Child and Dependent Care Expenses Lesson Plan

This lesson plan help learners understand the tax credit for child and dependent care expenses.

Internal Revenue Service

Irs: Tax Tutorial: Module 7: Standard Deduction

Learn about the standard deduction a single person may take on their income taxes with this tutorial.