Federal Reserve Bank

Income Taxes

Most adults dread April 15 — tax day! Tax preparation can be intimidating even for adults. Build confidence by leading individuals through the process and then give them a scenario to practice. The exercise uses tax vocabulary to give...

Council for Economic Education

Preparing a 1040EZ Income Tax Form

Some of us never feel like we know how to do our taxes! Help scholars understand the process early by using an informative resource. They fill out their own tax forms in a simulation activity and view multiple resources to learn even...

Curated OER

Understanding the Bush Tax Cut Plan

The class examines the new tax cut plan proposed by President Bush. They practice calculating income tax rates and interpreting the data. Then they research topics that are of interest to them related to taxes.

Council for Economic Education

Tax Time Scavenger Hunt

Is a 1040EZ tax form really easy? Scholars investigate the complexities of the United States taxation system with an economics lesson. Using a wide variety of web sources, they interpret IRS taxation rules and regulations to better...

Radford University

Percentages: Lesson 1

Math can be taxing at times. With a short lesson, pupils determine how income tax affects take-home pay. Learners determine their net pay based on tax tables and how adjustments in their gross pay changes the paycheck.

Visa

Financial Forces: Understanding Taxes and Inflation

Take the opportunity to offer your young adults some important financial wisdom on the way taxes and inflation will affect their lives in the future. Through discussion and review of different real-world scenarios provided...

Curated OER

Tax Forms and Deductions

Because many of your older students are probably getting their first jobs, it could be an appropriate time to discuss taxes. This presentation defines deductions, types of taxes, purposes of paying taxes, and the forms required to file...

Curated OER

Progressive Reforms

Tenth graders analyze editorial cartoons focusing on progressive reform. They compare their analysis and research. Students discuss the cost of reform leading to the creation of a national income tax through the passage of the 16th...

Federal Reserve Bank

Gini in a Bottle: Some Facts on Income Inequality

Delve into the hard numbers and fundamental concept of income inequality in the United States, using graphs, detailed reading materials, and an organized worksheet.

EngageNY

Federal Income Tax

Introduce your class to the federal tax system through an algebraic lens. This resource asks pupils to examine the variable structure of the tax system based on income. Young accountants use equations, expressions, and inequalities to...

Curated OER

Preparing a 1040EZ Income Tax Form

What do you do at the end of the year when your W2 arrives? File a tax form! Show learners how they to can fill out a basic 1040EZ tax form and play their part as tax paying citizens. Monetary denominations are provided for filling out...

Federal Reserve Bank

“W” Is for Wages, W-4 and W-2

Don't let your young adults get lost in the alphabet soup of their paychecks and federal income taxes. Using sample pay stubs and reproductions of government forms, your class members will identify the purpose of such forms as a W-4 and...

Curated OER

The Five W's of Tax Day

Use April 15th to teach your students the fundamentals of the American federal tax system.

PwC Financial Literacy

Planning and Money Management: Spending and Saving

Financial literacy is such an important, and often-overlooked, skill to teach our young people. Here is a terrific instructional activity which has pupils explore how to come up with a personal budget. They consider income, saving,...

Federal Reserve Bank

U.S. Income Inequality: It's Not So Bad

What is the difference between a flat tax, progressive tax, tax deduction and transfer payments? Pupils examine the ability-to-pay principle of taxation through discussion, problem solving, and a variety of worksheets on topics from US...

Federal Reserve Bank

Government Spending and Taxes

What types of government programs are designed to improve economic inequity in the United States? Introduce your learners to government programs, such as low-income housing, Social Security, and Medicaid, how they work to improve...

Practical Money Skills

Making Money

The first step in managing your money is making money! Learn about ways to find and interview for a job with a thorough lesson on personal finances. Kids learn about the ways to earn a paycheck and then manage the funds they receive.

Curated OER

Debate Topics and Ideas

Learners examine both sides of arguments surrounding given debates. They use the internet and other research to collect information to support their stand on the controversial issue. Students debate their chosen topic. This lesson plans...

University of Missouri

Money Math

Young mathematicians put their skills to the test in the real world during this four-lesson consumer math unit. Whether they are learning how compound interest can make them millionaires, calculating the cost of remodeling...

Curated OER

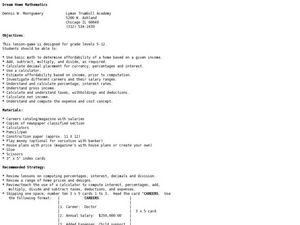

Dream Home Mathematics

Explore the concept of budgeting with sixth graders. They will pick a career on note card made by the teacher. They then use the information on the card such as salary, expenses, and career to create a life for themselves. They also...

Curated OER

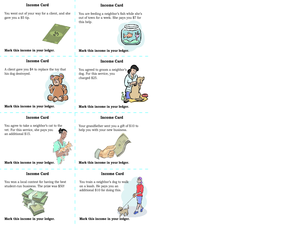

Income and Expenses

Learners discuss income and expenses. In this lesson on money, students define income and expenses, after whith they keep track of their income and expense transactions on a basic ledger.

Curated OER

Proportional Taxes

Students are able to define and give an example of a proportional tax and the impact that it can have on different income groups and explain how a proportional tax takes the same percentage from all tax groups.

Federal Reserve Bank

It's Your Paycheck

Beyond reading and arithmetic, one of the most important skills for graduating seniors to have is fiscal literacy and responsibility. Start them on the right financial track with nine lessons that focus on a variety of important...

Curated OER

Government Goods and Services

Fifth graders investigate the connection between taxes and government services. In this economics lesson, 5th graders discuss the process and benefits of paying sales and income taxes. Using calculators, students compute the...