Curated OER

Math Skills for Everyday: Filling Out Income Tax Forms

Students accurately assess their own income taxes using actual tax forms. They read and fill out the proper forms.

Curated OER

Federal Income Tax 1040EZ Worksheet Lesson

Students practice filling out the Federal Income Tax 1040EZ tax form.

Conneticut Department of Education

Personal Finance Project Resource Book

Balancing a budget, paying taxes, and buying a home may feel out of reach for your high schoolers, but in their adult years they will thank you for the early tips. A set of five lessons integrates applicable money math...

Radford University

Percentages: Lessons 2 and 3

What does salary have to do with it? Working in small groups, scholars use percentages to find simple interest and the value of a car they can afford on a given salary. Learners continue on to work with salaries and calculate amounts...

College Board

2009 AP® Macroeconomics Free-Response Questions Form B

If a country is facing rising unemployment, should the president ride out the trend or decrease income taxes? Scholars confront two competing policy recommendations and must decide what to do in a practice exam from College Board. Other...

Curated OER

A Look at Individual Federal Income Tax

Students investigate the concept of a personal federal income tax. They conduct research and participate in class discussion in order to deal some of the issues. They include why there is an individual income tax and how the money is...

Visa

Nothing But Net: Understanding Your Take Home Pay

Introduce your young adults to the important understanding that the money they receive from their paychecks is a net amount as a result of deductions from taxes. Other topics covered include federal, state, Medicare and social...

Internal Revenue Service

Fairness in Taxes: How Taxes Affect Us

Students are able to compare the effects of the following, using income as a measure of ability to pay: a progressive tax, a regressive tas, and a proportional tax. They explain how a mixture of regressive and progressive taxes could...

Curated OER

Money Math: Lessons for Life

Students explore money as it applies to salary, paychecks, and taxes. In this essential mathematics instructional activity, students explore how math is used in various careers, how income takes are calculated and other important life...

Curated OER

Fairness in Taxes: Progressive Taxes

Young scholars define and give an example of a progressive tax. They explain how a progressive tax takes a larger share of income from high-income groups than from low-income groups. They examine taxation in other countries.

Curated OER

Taxes: Where Does Your Money Go?

High schoolers explore the concept of taxes. In this tax lesson, students investigate types of taxes and deductions taken out of a paycheck before they see it. High schoolers calculate the tax on a given dollar amount. Students...

iCivics

Taxation

A paycheck stub can offer loads of information on the taxes American citizens pay. This resource not only includes analysis of a stub as an activity, but also provides a wealth of informative reading material on such topics as the...

Sierra College

"Deals on Wheels!" Car Loan Project

Help your class members learn how to use their income wisely with a comprehensive lesson plan on calculating monthly car payments. Using basic math skills and online calculators, your learners will determine the total amount to be...

Curated OER

Micro Economics - Personal Budgeting

High schoolers explore the real world as it relates to money and how people use it. In this money management lesson, students jump into the real world as they role play with money through spending, saving, being married, single, having...

Curated OER

What is Taxed and Why

Young scholars are exposed to the need for federal, state and local governments to tax constituents to provide goods and services for their residents. They identify the different kinds of taxes and give examples of the goods and services...

Federal Reserve Bank

Would Increasing the Minimum Wage Reduce Poverty?

Here is a fantastic and relevant question to discuss with your class members. Using detailed reading material and a related worksheet, your learners will learn about labor markets, equilibrium wages, price floors, and...

Curated OER

Taxes

Fourth graders read Stone Fax and explore earning money, saving, credit and taxes. In this taxes lesson, 4th graders complete a worksheet to develop understanding of paying off debts, keeping a checkbook, calculating sales tax and...

The New York Times

Understanding the Mathematics of the Fiscal Cliff

What exactly is the fiscal cliff? What are the effects of changing income tax rates and payroll tax rates? Your learners will begin by reading news articles and examining graphs illustrating the "Bush tax cuts" of 2001 and 2003. They...

Curated OER

Good News and Bad News: Income and Taxes

Students examine Internal Revenue Service (IRS) Form 1040, citing particular line items that are pertinent to an artist acting as an entrepreneur. They explore various sources of income and the importance of keeping accurate income records.

Curated OER

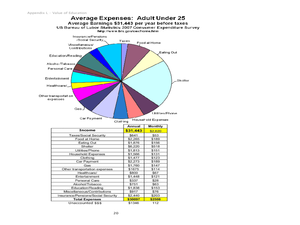

Money Math: Lessons for Life

Students develop a budget for a college student using all of the influences that the student would have. In this budgeting lesson plan, students use real life examples to create a budget spreadsheet. Students read and study...

Curated OER

Value of Education: Education and Earning Power

Students explore the earning power of someone with a post-high school education. In this education and income instructional activity, students evaluate examples of occupations, their salaries, and education level needed for the job....

National Endowment for the Humanities

Factory vs. Plantation in the North and South

North is to factory as South is to plantation—the perfect analogy for the economy that set up the Civil War! The first lesson in a series of five helps teach beginners why the economy creates a driving force for conflict. Analysis of...

Curated OER

Taxes: Where Does Your Money Go?

Young scholars study taxes and the role that they place in our lives. In this economic lesson, students explore the reality of taxes, how they work, why we pay them, where the money goes and how to make the most of the money you pay into...

Curated OER

Are Taxes "Normal?"

Students explore the concept of normal distribution. In this normal distribution lesson, students find the normal distribution of taxes in the 50 US states. Students make histograms, frequency tables, and find the mean and median of tax...