Curated OER

Lesson 2: How Taxes Evolve

Twelfth graders examine the legislative process of enacting federal income tax laws. They conduct research and report on the Federal Migratory Waterfowl Stamp (Duck Stamp) Act of 1934.

Curated OER

How Taxing are Taxes?

Students explore the ways that taxes are levied based on taxable income. They analyze how a new series of tax cuts might affect people of different income levels and their tax rates.

Curated OER

Interest Income

Students identify taxable interest income, and report taxable and tax-exempt interest income.

Curated OER

Regressive Taxes

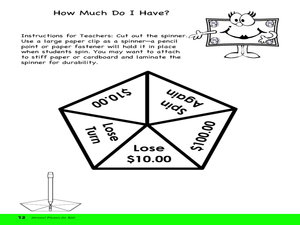

Students explain that regressive taxes can have different effects on different income groups. They see how a regressive tax takes a larger share of income from low-income groups than from high-income groups.

Curated OER

Module 12-Self-Employment Income and the Self-Employment Tax

Students explain self-employment income and the self-employment tax. They distinguish between an employee and an independent contractor and explain how to compute and report self-employment profit.

Curated OER

Taxes

Fourth graders explore the concept of taxes and gather relevant information to become a tax 'expert. For this taxes lesson, 4th graders work in teams to find information regarding different areas in taxes. Students work together to...

Curated OER

Fairness in Taxes

Students identify and describe two criterion of tax fairness: benefits received and the ability to pay and distinguish between wealth and income as measures of ability to pay.

Curated OER

ADULT ESOL LESSON PLAN--Level 3--Obtaining Employment

Students examine and view a variety of employment facts/legalities that comes with employment in the United States including social security, income tax deductions and W-4 forms, just to mention a few.

Curated OER

Dependents and Tax Credits

Students identify "count" and "non-count" nouns, and examine and discuss the Earned Income Tax Credit. They define key vocabulary words, complete various worksheets, read a newspaper article, and answer discussion questions.

Curated OER

Your First Job

Students determine that they are responsible for paying income taxes through withholdings on earned income. They examine the Form W-4.

Curated OER

Income Statement

Students demonstrate the proper way to prepare an income statement. They calculate a company's Gross Profit, Operating Expenses, Income from Operation before tax and Net Income, then determine the company's net income or net loss during...

Curated OER

Stone Fox

Students use the book, Stone Fox, to explore income, capital, saving, taxes, and credit. Stone Fox tells the story of Little Willy, a ten year old who enters a challenging dog-sled race in hopes of winning money to pay the back taxes on...

Curated OER

Exemptions

Learners explain how exemptions affect income that is subject to tax, and determine the number of exemptions to claim on a tax return.

Curated OER

Earned Income Credit

Students distinguish between tax deduction and tax credit, explain how the earned income credit affects the tax liability, apply requirements to claim the earned income credit, and describe factors that determine the amount of the earned...

Curated OER

Utah's Tax Situation

Young scholars examine Utah's tax burden as relative to other states, explore types of taxes levied in Utah, including property, personal income, and sales taxes, define tax-related vocabulary, and conduct research to complete critical...

Curated OER

The Politics Of Taxation

Students explain that taxation involves a compromise of conflicting goals and that lobbyists can influence lawmakers' decisions about taxes. They can explain why people of similar incomes often pay different tax rates and work in teams...

Curated OER

Taxes

Students use the internet to examine the various types of taxes. Using this information, they develop a chart comparing and contrasting the types and determinations of how much tax needs to be paid. They share their charts with the...

Curated OER

Taking Taxes

Students discuss the role of taxes and tax deductions in the maintence of community services. A practice W-4 form is completed by students who identify their exemptions. This lesson is intended for students acquiring English.

Curated OER

The Tax Man Cometh

Students examine websites and resources related to Bush's 2001 tax plan. They discuss the history of taxes and other tax topics. They look for evidence in the local newspaper of government spending at work.

Curated OER

Mueller v. Allen

Students investigate a First Amendment legal case involving religion, education, and reimbursement of tuition payments. They research the background of the cases and its precedents.

Curated OER

Stone Fox and Economics

Students read the novel Stone Fox and review economic concepts including income, goods, and services. They define the following terms: capital, credit, credit risk and summarize their reading by reading several chapters at a time. They...

Curated OER

Wealth

Third graders read the story The Day I Was Rich and learn about the role of money and taxes. For this money lesson plan, 3rd graders count large sums of money, group them, and give it away in the form of taxes. They discuss wealth and...

Curated OER

Math and Money

Students explore personal finance. For this middle school mathematics lesson, students investigate banking, income tax, and the cost of living. The lesson includes two bonus lessons on graphing their personal spending habits...

Curated OER

Dependents

Students explain dependency exemption and how it affects taxable income, and apply the five dependency tests to determine whether a person can be claimed as a dependent.