Curated OER

Module 13-Electronic Tax Return Preparation and Transmission

Students explain the electronic preparation and transmission of tax returns. They describe the ways to prepare and transmit tax returns and explain the benefits of electronic tax return preparation and transmission.

Curated OER

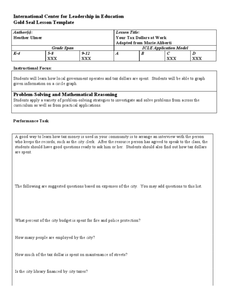

Your Tax Dollars at Work

In order to understand how tax dollars are spent, young economists use given data and graph it on a circle graph. Circle graphs are highly visual and can help individuals describe data. A class discussion follows the initial activity.

Curated OER

Understanding Tax: Your Role as a Tax Payer

Every adult should know that it is their responsibility to help fund public goods and services by paying taxes. Help young people get a handle on the history, evolution, purposes for, and reasons why they should pay taxes too.

Internal Revenue Service

Fairness in Taxes: How Taxes Affect Us

Students are able to compare the effects of the following, using income as a measure of ability to pay: a progressive tax, a regressive tas, and a proportional tax. They explain how a mixture of regressive and progressive taxes could...

Curated OER

Using the newspaper to learn about state and local government

Students investigate the purposes of state and local government. They categorize newspaper articles into state and local issues. Pupils summarize nonfiction text. Students given an oral presentation on a news report to the class.

Visa

Nothing But Net: Understanding Your Take Home Pay

Introduce your young adults to the important understanding that the money they receive from their paychecks is a net amount as a result of deductions from taxes. Other topics covered include federal, state, Medicare and social...

Curated OER

Citizenship Worksheet 5 - Local and State Government

The Tenth Amendment of the United States Constitution delegates rights that have not been defined by the federal government to the states. But what are the responsibilities of state governments? What about county and city governments?...

iCivics

Taxation

A paycheck stub can offer loads of information on the taxes American citizens pay. This resource not only includes analysis of a stub as an activity, but also provides a wealth of informative reading material on such topics as the...

Curated OER

What is Taxed and Why

Young scholars are exposed to the need for federal, state and local governments to tax constituents to provide goods and services for their residents. They identify the different kinds of taxes and give examples of the goods and services...

Curated OER

Lesson Plan: Figuring Sales Taxes

Students define and discuss sales tax, identify items for which they do or do not have to pay sales tax, research information online about sales tax in their state, and complete practice sheet that requires calculating sales tax percent...

Curated OER

The Wealth Tax of 1935 and the Victory Tax of 1942

Young scholars explain that during the Great Depression and World War II, the Roosevelt administration implemented new, broader, and more progressive taxes in order to cover the costs of the New Deal programs and the war.

Curated OER

Prairie Voices: Community Development, Investigating Local History

Students investigate local history. In this research skills lesson, students examine historic landmarks, tax records, fire maps, town plans, historic photographs, newspapers, and other primary sources to learn about local communities in...

Curated OER

Qualifying to Vote Under Jim Crow

Literacy tests, poll taxes, grandfather laws? Scholars study the systematic ways African-Americans were kept from voting even after it was made a law. They analyze a series of primary source documents, complete a worksheet, and engaged...

BBC

Local Democracy

Expanding our students' understanding of government at a local level is a great way to build an understanding of government at a global level. Start the understanding by using any of these fun teaching ideas. Learners engage in several...

Curated OER

Government Goods and Services

Fifth graders investigate the connection between taxes and government services. In this economics instructional activity, 5th graders discuss the process and benefits of paying sales and income taxes. Using calculators,...

Curated OER

Identifying the Purposes of Local Government

Students work cooperatively in small groups to identify the purposes of local government. They review the five broad purposes of local government and match the services of government to the appropriate purpose.

Curated OER

Utah's Tax Situation

Young scholars examine Utah's tax burden as relative to other states, explore types of taxes levied in Utah, including property, personal income, and sales taxes, define tax-related vocabulary, and conduct research to complete critical...

Curated OER

The Tax Man Cometh

Students examine websites and resources related to Bush's 2001 tax plan. They discuss the history of taxes and other tax topics. They look for evidence in the local newspaper of government spending at work.

Council for Economic Education

Banks and Credit Unions (Part 1)

Imagine you have money you want to save ... where do you put it? Pupils investigate the similarities and differences of banks and credit unions as they determine where exactly to place their hard-earned money. Through a WebQuest,...

Beyond Benign

Truckin’ to Your Table

Food takes a trip to the table. Class members choose a meal from a menu and calculate the total cost of the meal including tax and tip. Using a food origin card, pupils determine how far each of the ingredients of a meal traveled to end...

Curated OER

Your First Job

Students determine that they are responsible for paying income taxes through withholdings on earned income. They examine the Form W-4.

Curated OER

Percent Applications

In this percent application instructional activity, students solve word problems containing concepts such as percent, proportions, sale price, discounts, interest, commission, tax, and more. Students complete 11 problems.

University of Missouri

Money Math

Young mathematicians put their skills to the test in the real world during this four-lesson consumer math unit. Whether they are learning how compound interest can make them millionaires, calculating the cost of remodeling...

Curated OER

Math and Your Local Restaurant

Connect ratios, fractions, scale factor, percents, and elapsed time to restaurants.