Council for Economic Education

Preparing a 1040EZ Income Tax Form

Some of us never feel like we know how to do our taxes! Help scholars understand the process early by using an informative resource. They fill out their own tax forms in a simulation activity and view multiple resources to learn even...

Curated OER

Corporate Tax Rate and Jobs

Does lowering the corporate tax rate help create jobs in the United States? Learners explore the top pro and con arguments and quotes relating to the issue. They read background information about the creation of the federal corporate...

Federal Reserve Bank

U.S. Income Inequality: It's Not So Bad

What is the difference between a flat tax, progressive tax, tax deduction and transfer payments? Pupils examine the ability-to-pay principle of taxation through discussion, problem solving, and a variety of worksheets on topics from US...

Curated OER

Proportional Taxes

Students are able to define and give an example of a proportional tax and the impact that it can have on different income groups and explain how a proportional tax takes the same percentage from all tax groups.

Internal Revenue Service

Fairness in Taxes: How Taxes Affect Us

Students are able to compare the effects of the following, using income as a measure of ability to pay: a progressive tax, a regressive tas, and a proportional tax. They explain how a mixture of regressive and progressive taxes could...

Curated OER

Fairness in Taxes: Progressive Taxes

Young scholars define and give an example of a progressive tax. They explain how a progressive tax takes a larger share of income from high-income groups than from low-income groups. They examine taxation in other countries.

Curated OER

Taxes in U.S. History: Tax Reform in the 1960s and 1980s

Students explain the content, purpose, and impact of the Tax Reform Acts of 1969 and 1986.

Curated OER

Churches and Taxes

Churches have been tax-exempt since the founding of America, but should they be? Pupils ponder the question as they browse the website in preparation for a class debate or discussion. They research the history of tax-exemption for...

PwC Financial Literacy

Planning and Money Management: Spending and Saving

Financial literacy is such an important, and often-overlooked, skill to teach our young people. Here is a terrific lesson plan which has pupils explore how to come up with a personal budget. They consider income, saving, taxes, and their...

Curated OER

Micro Economics - Personal Budgeting

High schoolers explore the real world as it relates to money and how people use it. In this money management lesson, students jump into the real world as they role play with money through spending, saving, being married, single, having...

Curated OER

Taxes in U.S. History: Evolution of Taxation in the Constitution

Students receive an overview of the role and purpose of taxes in American history. They identify different types of taxes implemented by the US government and explain the origin of the federal income tax.

Curated OER

Are Taxes "Normal?"

Students explore the concept of normal distribution. In this normal distribution lesson, students find the normal distribution of taxes in the 50 US states. Students make histograms, frequency tables, and find the mean and median of tax...

National Constitution Center

Interactive Constitution

Did you know there are seven Articles and 27 Amendments to the US Constitution? Explore each and every one of them, including the Bill of Rights and other rights around the world, in a super neat US Constitution interactive.

Curated OER

Discretionary and Automatic Fiscal Policy

Explore fiscal policies using this worksheet. Learners discuss economic policies as it relates to employment, aggregate demand, income tax rates, and recession.

Curated OER

Taking Taxes

Students discuss the role of taxes and tax deductions in the maintence of community services. A practice W-4 form is completed by students who identify their exemptions. This lesson is intended for students acquiring English.

Curated OER

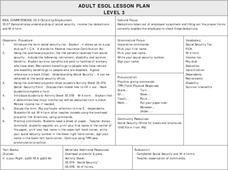

ADULT ESOL LESSON PLAN--Level 3--Obtaining Employment

Students examine and view a variety of employment facts/legalities that comes with employment in the United States including social security, income tax deductions and W-4 forms, just to mention a few.

Practical Money Skills

Making Money

The first step in managing your money is making money! Learn about ways to find and interview for a job with a thorough lesson on personal finances. Kids learn about the ways to earn a paycheck and then manage the funds they receive.

Curated OER

Civics Test for Citizenship: History and Government (51-100)

Use this presentation to help English learners prepare for their upcoming citizenship test. It includes questions 51-100 from the History and Government section of the exam (questions 1-50 can be found in a different presentation, linked...

Curated OER

Whole Numbers

In this whole numbers worksheet, students solve and complete 40 different word problems. First, they determine the amount of a paycheck once income tax is paid. Then, students determine the balance of an account after a deposit described...

Curated OER

Married Math

Students participate in a two-week real-life math unit. In pairs, they calculate salaries, taxes, and a budget, plan a vacation, buy insurance, make a will, and design a room. They conduct Internet research to plan the vacation, and...

Curated OER

ESOL 18 Obtaining Employment

Students examine the terms social securtiy tax, social security, retirement and benefits. They respond to different commands about forms needed for employment. They practice filling out Social Security and W-4 forms.

Curated OER

A Trillion Here...A Trillion There

In this working with large numbers worksheet, students are given the finance statistics for the US and the world for the 2006-2007 year. Students solve 11 problems including finding averages and percentages for the given statistics and...

Curated OER

Home Sweet Home

In this Pilgrims worksheet, students analyze 12 pictures of common household items. Students circle all the pictures that show something that would have been found in a Pilgrim home.

Curated OER

Be Your Own Cahncellor

Students analyze the funding strategies of a modern central government. Individuals or groups construct a plan for increasing spending and making cutbacks in various government programs. Students examine the importance of taxes on the...