Internal Revenue Service

Irs: Payroll Taxes and Federal Income Tax Withholding

Payroll taxes include the Social Security tax and the Medicare tax. Social Security taxes provide benefits for retired workers, the disabled, and the dependents of both. The Medicare tax is used to provide medical benefits for certain...

Internal Revenue Service

Irs: Payroll Taxes and Federal Income Tax Withholding Lesson Plan [Pdf]

This lesson will help students understand the withholding of payroll and income taxes from pay.

Internal Revenue Service

Irs: Payroll Taxes and Federal Income Tax Withholding Assessment

Answer the following multiple-choice and true/false questions about payroll taxes and federal income tax withholding by clicking on the correct answers. To assess your answers, click the Check My Answers button at the bottom of the page.

Internal Revenue Service

Irs: Payroll Taxes and Federal Income Tax Withholding Lesson Plan

This lesson plan will help students understand the withholding of payroll and income taxes from pay.

Internal Revenue Service

Irs: Income Tax Issues Lesson Plan

This lesson plan will help students understand how and why a federal income tax was implemented by Congress during the Civil War and in 1913.

Internal Revenue Service

Irs: Module 1: Payroll Taxes and Federal Income Tax Withholding

A tax tutorial that will cover payroll taxes, income tax withholding from employees' pay, and how to complete form W-4.

Consumer Financial Protection Bureau

Cfpb: Investigating Payroll Tax and Federal Income Tax Withholding

Students analyze W-4 forms and paystubs in order to better understand payroll taxes and federal income tax withholding.

US National Archives

Nara: Income Tax Records of the Civil War Years

This article presents an excellent historical overview of the income tax as well as look at the tax records of the Civil War years.

Internal Revenue Service

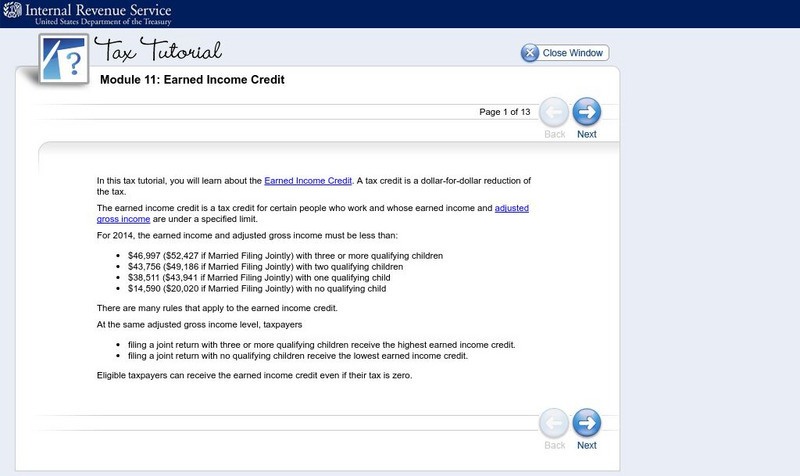

Irs: Tax Tutorial: Module 11: Earned Income Credit

This tax module explores what the earned income credit is and how taxpayers qualify for the credit.

Internal Revenue Service

Irs: Tax Tutorial: Module 12: Refund, Amount Due and Recordkeeping

Learn about how refunds are processed in a tax return with this module.

Social Security Administration

Social Security: Withholding Income Tax From Your Social Security Benefits

The site gives information on the option of having federal taxes withheld from Social Security benefits.

Internal Revenue Service

Irs: Online Services and Tax Information for Individuals

In a conversational tone, the IRS answers many of the questions an individual would have when filing income tax returns for the first time. Many features are helpful even to experienced taxpayers, e.g., an IRS withholding calculator, a...

Internal Revenue Service

Irs: Your First Job Lesson Plan

This lesson plan will help young scholars understand that they are responsible for paying income taxes through withholding as they earn income and that it is important that they keep accurate records of their earnings and expenses.

Internal Revenue Service

Understanding Taxes : The Wealth Tax of 1935 and the Victory Tax of 1942

This lesson plan from the Internal Revenue Service gives the history of the progressive income tax which helped fund the social programs implemented during the Great Depression, and the war effort after the country joined the Allies in...

Internal Revenue Service

Irs: How Taxes Evolve? Lesson Plan

This lesson plan will help students understand that the legislative process of enacting federal income tax laws involves formal procedures based on the Constitution and informal procedures that blend and balance various interests.

Internal Revenue Service

Irs: Tax Tutorial: Module 13: Electronic Tax Return Preparation and Transmission

This tutorial explores e-filing your income taxes.

Internal Revenue Service

Irs: Tax Tutorial: Module 10: Education Credits

A learning module exploring how education credits can be applied to income taxes.

Internal Revenue Service

Irs: Tax Tutorial: Module 7: Standard Deduction

Learn about the standard deduction a single person may take on their income taxes with this tutorial.

Bankrate

Bankrate.com: Taxes

This site explores the basics of taxes including finding your tax bracket, income tax calculator, earned income tax, state taxes, states with no income tax, and capital gains.

Council for Economic Education

Econ Ed Link: Taxes and Income

Use this interactive graph to gain an understanding of how taxes increase as your income goes up. The y-intercept line shows the base tax amount for no income.

Internal Revenue Service

Irs: Interest Income

This lesson plan will help students understand that most interest income is taxable.

Internal Revenue Service

Irs: Earned Income Credit Lesson Plans

This lesson plan will help young scholars understand the earned income credit.

Internal Revenue Service

Irs: Claiming a Child Tax Credit Lesson Plan

This lesson plan will help students understand the child tax credit and additional child tax credit.

Internal Revenue Service

Irs: Tax Credit for Child and Dependent Care Expenses Lesson Plan

This lesson plan help students understand the tax credit for child and dependent care expenses.

Other popular searches

- Filing Income Taxes

- Income Taxes 1040ez

- Income Taxes Teachers Lesson

- U.s. Income Taxes

- Preparing Income Taxes

- Paying Income Taxes

- 1040 Ex Income Taxes

- Lessons on Income Taxes

- Personal Income Taxes

- Federal Income Taxes

- 1040 Ez Income Taxes

- Us Income Taxes

![Irs: Payroll Taxes and Federal Income Tax Withholding Lesson Plan [Pdf] Lesson Plan Irs: Payroll Taxes and Federal Income Tax Withholding Lesson Plan [Pdf] Lesson Plan](https://d15y2dacu3jp90.cloudfront.net/images/attachment_defaults/resource/large/FPO-knovation.png)