Internal Revenue Service

Irs: 1040 Ez [Pdf]

This site provides help with as well as an explanation of the IRS tax form, 1040EZ.

Internal Revenue Service

Irs: Standard Deduction Lesson Plan

This lesson plans will help learners understand the standard deduction and how it affects income that is subject to tax.

Internal Revenue Service

Irs: Exemptions Lesson Plan

This lesson plan will help students understand personal and dependency exemptions and how exemptions affect income that is subject to tax.

Siteseen

Siteseen: Government and Constitution: 16th Amendment

Provides an explanation and summary of the 16th Amendment or Income Tax Clause that authorizes Congress to collect income taxes.

US Department of the Treasury

Secretaries of the Treasury: William G. Mc Adoo

William McAdoo's tenure as Secretary of the Treasury under Woodrow Wilson is overviewed on the official site of the U.S. Department of the Treasury. Read about the accomplishments of the Treasury Department under McAdoo including the...

Internal Revenue Service

Understanding Taxes: The Social Security Act of 1935

This very complete lesson plan explains the history of the Social Security Act of 1935, its history and importance to the elderly during the Great Depression, and its importance today. Everything necessary to teach the lesson plan and...

Consumer Financial Protection Bureau

Consumer Financial Protection Bureau: Calculating the Numbers in Your Paycheck

Students review a pay stub from a sample paycheck to understand the real-world effect of taxes and deductions on the amount of money they take home.

Wolters Kluwer

Small Business Guide: Defining Your Work Area

This site discusses the functionality and cost of locating your business in the home. Topics such as the type of business and why you chose the home to locate your business are discussed. A link to income tax write-offs is provided.

Annenberg Foundation

Annenberg Classroom: Federal Taxation

Check out this interactive timeline documenting the history of federal taxation in the United States.

Digital History

Digital History: The Clinton Presidency

Short, but comprehensive, synopsis of Clinton's two terms as president. Included in the article is the 1992 campaign, successful and controversial legislation, and the scandals that would eventually become part of his presidential legacy.

Digital History

Digital History: Conservative Policies and Presidents [Pdf]

Starting in 1920 the United States had three presidents who followed conservative policies. Read about their policies, and determine whether they made the U.S. a more economically sound country. [pdf]

Internal Revenue Service

Irs: How to Measure Fairness Lesson Plans

This lesson plan will help learners understand that people have difficulty agreeing on a fair tax because of different values and priorities.

University of Groningen

American History: Documents: Pollock v. Farmer's Loan and Trust Co. 1895

Read the complete text of the landmark Supreme Court case of Pollock v. Farmer's Loan and Trust Co. 1895.

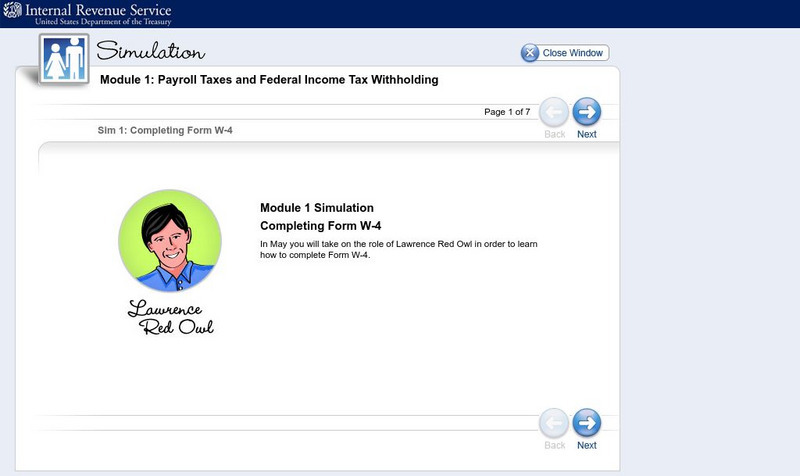

Internal Revenue Service

Irs: Completing a W 4

In May you will take on the role of Lawrence Red Owl in order to learn how to complete Form W-4.

US National Archives

Our Documents: A National Initiative on American History, Civics, and Service

Our Documents is home to one hundred milestone documents that influenced that course of American history and American democracy. Includes full-page scans of each document, transcriptions, background information on their significance, and...

Other

Tsu: The Progressive Era and World War I

A comprehensive outline covering the major ideas, leaders, and actions of the Progressive Era and the transformation of the United States as a result of World War I.

Internal Revenue Service

Irs: The Irs Yesterday and Today Lesson Plan

This lesson plan will help students understand why the Internal Revenue Service was instituted, how it functions, how it has changed over the years, and the ways it helps taxpayers today.

Harp Week

Harp Week: The Presidential Elections: 1896 Mc Kinley v. Bryan

A three-page look at the campaign and election of 1896 in which William McKinley, the Republican candidate, ran against Wiliam Jennings Bryan, the Democratic candidate. Read about the nominating conventions, the platforms, and the...

Other

Premier Payroll Research Library: Fringe Benefits

This article has the employer realize the importance of reporting fringe benefits to the IRS. This explains what fringe benefits are. Lists certain benefits that may be excluded from income as well as others which may not be excluded.

University of Georgia

University of Georgia: Piecewise Linear Functions

Piecewise linear functions are presented with examples and definitions. See how piecewise functions are applied to real-world situations through an example with income taxes.

Khan Academy

Khan Academy: Aggregate Demand in Keynesian Analysis

This article examines each component of aggregate demand from the Keynesian perspective. Includes a table summarizing the information in the article, review questions, and critical thinking questions.

Council for Economic Education

Econ Ed Link: Where Does the Money Come From?

With very few exceptions, the U.S. federal government does not have an "income" to spend providing goods and services. The money used for federal spending programs must be collected as federal taxes, or it must be borrowed. This...

Other

National Endowment for Financial Education: Smart About Money

On this site students can learn about financial planning and the many decisions adults have to make during life events and their money. Helpful tips, printable worksheets and links to additional resources are provided on a wide variety...

Vassar College

Vassar College: Democratic Party Platform, July 9, 1896

This "1896, A Website for Political Cartoons" site provides text of the actual platform stating the Democratic stand on "The Money Question." of 1896.

Other popular searches

- Filing Income Taxes

- Income Taxes 1040ez

- Income Taxes Teachers Lesson

- U.s. Income Taxes

- Preparing Income Taxes

- Paying Income Taxes

- 1040 Ex Income Taxes

- Lessons on Income Taxes

- Personal Income Taxes

- Federal Income Taxes

- 1040 Ez Income Taxes

- Us Income Taxes

![Irs: 1040 Ez [Pdf] eBook Irs: 1040 Ez [Pdf] eBook](https://d15y2dacu3jp90.cloudfront.net/images/attachment_defaults/resource/large/FPO-knovation.png)