Curated OER

Lesson 2: How Taxes Evolve

Twelfth graders examine the legislative process of enacting federal income tax laws. They conduct research and report on the Federal Migratory Waterfowl Stamp (Duck Stamp) Act of 1934.

Curated OER

Utah's Tax Situation

Young scholars examine Utah's tax burden as relative to other states, explore types of taxes levied in Utah, including property, personal income, and sales taxes, define tax-related vocabulary, and conduct research to complete critical...

Curated OER

Taxes

Students use the internet to examine the various types of taxes. Using this information, they develop a chart comparing and contrasting the types and determinations of how much tax needs to be paid. They share their charts with the...

Curated OER

Taking Taxes

Students discuss the role of taxes and tax deductions in the maintence of community services. A practice W-4 form is completed by students who identify their exemptions. This lesson is intended for students acquiring English.

Curated OER

The Tax Man Cometh

Students examine websites and resources related to Bush's 2001 tax plan. They discuss the history of taxes and other tax topics. They look for evidence in the local newspaper of government spending at work.

University of Missouri

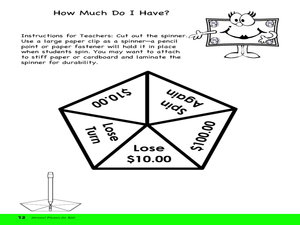

Money Math

Young mathematicians put their skills to the test in the real world during this four-lesson consumer math unit. Whether they are learning how compound interest can make them millionaires, calculating the cost of remodeling...

Curated OER

Discretionary and Automatic Fiscal Policy

Explore fiscal policies using this worksheet. Learners discuss economic policies as it relates to employment, aggregate demand, income tax rates, and recession.

Curated OER

ADULT ESOL LESSON PLAN--Level 3--Obtaining Employment

Students examine and view a variety of employment facts/legalities that comes with employment in the United States including social security, income tax deductions and W-4 forms, just to mention a few.

Federal Reserve Bank

It's Your Paycheck

Beyond reading and arithmetic, one of the most important skills for graduating seniors to have is fiscal literacy and responsibility. Start them on the right financial track with nine lessons that focus on a variety of important...

Curated OER

Math and Money

Students explore personal finance. For this middle school mathematics lesson, students investigate banking, income tax, and the cost of living. The lesson includes two bonus lessons on graphing their personal spending habits...

Curated OER

Methods of Filing

Pupils explain the methods of filing tax returns and the advantages of preparing and transmitting tax returns electronically. They identify the return method that is most appropriate for certain taxpayers.

Curated OER

Mueller v. Allen

Students investigate a First Amendment legal case involving religion, education, and reimbursement of tuition payments. They research the background of the cases and its precedents.

Curated OER

Advanced Math Budget Project

What financial situations and decisions await young learners after they graduate from high school? This project allows class members to glimpse into the types of responsibilities they will have as adults, from considering job...

Practical Money Skills

Making Money

The first step in managing your money is making money! Learn about ways to find and interview for a job with a thorough lesson on personal finances. Kids learn about the ways to earn a paycheck and then manage the funds they receive.

Nebraska Department of Education

Managing My Money

Rent, food, utilities, gas, clothing, taxes! It all adds up. As part of a career planning and management unit, high school sophomores learn about financial planning and budgeting.

Curated OER

Exemptions

Learners explain how exemptions affect income that is subject to tax, and determine the number of exemptions to claim on a tax return.

Curated OER

Stone Fox and Economics

Students read the novel Stone Fox and review economic concepts including income, goods, and services. They define the following terms: capital, credit, credit risk and summarize their reading by reading several chapters at a time. They...

Curated OER

Dependents

Students explain dependency exemption and how it affects taxable income, and apply the five dependency tests to determine whether a person can be claimed as a dependent.

Curated OER

Wealth

Third graders read the story The Day I Was Rich and learn about the role of money and taxes. For this money lesson plan, 3rd graders count large sums of money, group them, and give it away in the form of taxes. They discuss wealth and...

Curated OER

Basic Budgeting

Students create a personal budget. In this creating a personal budget lesson, students create a list of 3 necessary things they need to survive. Students rank these things in order of importance and determine their...

PBS

Where Does Your Paycheck Go?

Upper elementary learners explore the concept of taxes taken out of an employee's paycheck. As they work through this lesson, young mathematicians discover the difference between gross pay and net pay. They also see what types...

Curated OER

Family Income

Students examine income statistics from the 2001 Census for four types of families in Canada. They appreciate the cost of running a household and the importance of tailoring expenses to match income.

Radford University

Percentages: Lessons 2 and 3

What does salary have to do with it? Working in small groups, scholars use percentages to find simple interest and the value of a car they can afford on a given salary. Learners continue on to work with salaries and calculate amounts...

Curated OER

Civics Test for Citizenship: History and Government (51-100)

Use this presentation to help English learners prepare for their upcoming citizenship test. It includes questions 51-100 from the History and Government section of the exam (questions 1-50 can be found in a different presentation, linked...

Other popular searches

- Filing Income Taxes

- Income Taxes 1040ez

- Income Taxes Teachers Lesson

- U.s. Income Taxes

- Preparing Income Taxes

- Paying Income Taxes

- 1040 Ex Income Taxes

- Lessons on Income Taxes

- Personal Income Taxes

- Federal Income Taxes

- 1040 Ez Income Taxes

- Us Income Taxes