Curated OER

Orchestra Tax Battle

Students read a newspaper article about the controversial taxation of an orchestra. They define vocabulary, complete comprehension worksheets, analyze the use of verb forms in the article and take a 'true or false' quiz.

Curated OER

No Taxing of the Tea for Thee

Research the history of the Boston Tea Party. Learners read the book The Boston Tea Party and write down important facts. They use the Internet to continue their research and construct an art project of a boat that contains a tea bag.

Federal Reserve Bank

Would Increasing the Minimum Wage Reduce Poverty?

Here is a fantastic and relevant question to discuss with your class members. Using detailed reading material and a related worksheet, your learners will learn about labor markets, equilibrium wages, price floors, and...

Curated OER

Circular Flows

To study circular flow, learners use the plans to trace through a series of interconnected economic and financial flows to explain the workings of the American economy. They use the model developed to comprehend the effects of Federal...

PBL Pathways

Tax Examination

What are your chances of being audited by the IRS? An engaging problem scenario asks pupils to examine the likelihood of being audited compared to factors such as receiving a refund or claiming a home office. The final product of...

Curated OER

Your First Job

Students determine that they are responsible for paying income taxes through withholdings on earned income. They examine the Form W-4.

Curated OER

Methods of Filing

Pupils explain the methods of filing tax returns and the advantages of preparing and transmitting tax returns electronically. They identify the return method that is most appropriate for certain taxpayers.

Curated OER

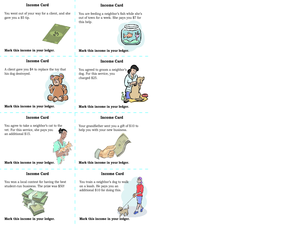

Interest Income

Students identify taxable interest income, and report taxable and tax-exempt interest income.

Curated OER

Exemptions

Learners explain how exemptions affect income that is subject to tax, and determine the number of exemptions to claim on a tax return.

Curated OER

Go Figure! Using Percents in the Real World

Sixth graders solve sales tax problems. In this solving sales tax problems lesson, 6th graders find the sales tax on various items. Students are given a list of expenses that a family spent on vacation before taxes. ...

Curated OER

Computing Costs

Seventh graders calculate the out-of-pocket money needed to purchase a discounted item taxed at a certain percentage of sales tax.

Curated OER

Shopping Spree

Students calculate discounts, sale price, and sale tax. In this consumer math lesson plan, students visit mock stores which have items for sale. Students calculate the final prices of items.

PBS

Where Does Your Paycheck Go?

Upper elementary learners explore the concept of taxes taken out of an employee's paycheck. As they work through this lesson, young mathematicians discover the difference between gross pay and net pay. They also see what types...

Curated OER

Wealth

Third graders read the story The Day I Was Rich and learn about the role of money and taxes. For this money lesson plan, 3rd graders count large sums of money, group them, and give it away in the form of taxes. They discuss wealth and...

Curated OER

Let's Go Shopping with $500

Third graders use a worksheet to budget a five-hundred dollar shopping spree. They select goods to purchase, figure totals and then calculate discounts and sales tax. They compare results to determine who purchased the most for his or...

Curated OER

What Does Percent Have to Do With It?

Fourth graders go shopping for a real life experience involving percent. They explore the concepts of sales tax and discount prices.

Curated OER

Percent Applications

In this percent application instructional activity, students solve word problems containing concepts such as percent, proportions, sale price, discounts, interest, commission, tax, and more. Students complete 11 problems.

Curated OER

"No Stamped Paper to Be Had"

Students examine primary documents pertaining to the Stamp Act to explain colonial objections to the expansion of taxes.

Curated OER

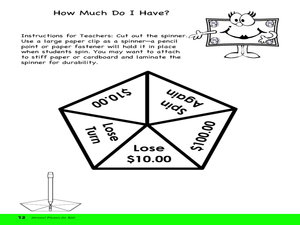

Income and Expenses

Learners discuss income and expenses. In this lesson on money, students define income and expenses, after whith they keep track of their income and expense transactions on a basic ledger.

Curated OER

Taxes: Where Does Your Money Go?

Young scholars study taxes and the role that they place in our lives. In this economic lesson, students explore the reality of taxes, how they work, why we pay them, where the money goes and how to make the most of the money you pay into...

Curated OER

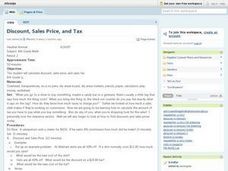

Discount, Sales Price, and Tax

Eighth graders calculate discount, sales price, and sales tax. They are given various problems to work out and even have to figure how much they would make if they were working on commission as well. Students have to figure out which...

Curated OER

John McCain's Tax Stand Misrepresented

Students examine how political advertisements can be misleading. Using a political ad against tax reform, students generate questions based on the claims in the ads. They research information to support or refute the claims in the ad and...

Curated OER

Shop 'Til You Drop: Food for Thought

Students shop in a virtual grocery store. Students choose items for their shopping cart and check out. They determine the tax, delivery fees, and total cost. Students discuss the advantages and disadvantages of shopping on the internet.

Curated OER

Why were Americans upset with the British Government?

Fourth graders examine the Revolutionary War in New York State. In this experiential hook lesson, 4th graders adhere to new rules imposed by the teacher. Students document their feelings and frustrations with being taxed on using...

Other popular searches

- World Taxes

- Income Taxes

- Federal Taxes

- Local Government and Taxes

- Local Government Taxes

- Paying Taxes

- Benefits of Taxes

- Compute Taxes

- State Taxes

- Local Taxes

- Filing Income Taxes

- Payroll Taxes