Curated OER

Are Taxes "Normal?"

Students explore the concept of normal distribution. In this normal distribution lesson, students find the normal distribution of taxes in the 50 US states. Students make histograms, frequency tables, and find the mean and median of tax...

Curated OER

Money Math: Lessons for Life

Students explore money as it applies to salary, paychecks, and taxes. In this essential mathematics instructional activity, students explore how math is used in various careers, how income takes are calculated and other important life...

Curated OER

How Taxing are Taxes?

Students explore the ways that taxes are levied based on taxable income. They analyze how a new series of tax cuts might affect people of different income levels and their tax rates.

Curated OER

Interest Income

Students identify taxable interest income, and report taxable and tax-exempt interest income.

Curated OER

Module 12-Self-Employment Income and the Self-Employment Tax

Pupils explain self-employment income and the self-employment tax. They distinguish between an employee and an independent contractor and explain how to compute and report self-employment profit.

Curated OER

Taxes

Fourth graders explore the concept of taxes and gather relevant information to become a tax 'expert. In this taxes lesson plan, 4th graders work in teams to find information regarding different areas in taxes. Students work together to...

Curated OER

The Wealth Tax of 1935 and the Victory Tax of 1942

Students explain that during the Great Depression and World War II, the Roosevelt administration implemented new, broader, and more progressive taxes in order to cover the costs of the New Deal programs and the war.

Curated OER

Fairness in Taxes

Students identify and describe two criterion of tax fairness: benefits received and the ability to pay and distinguish between wealth and income as measures of ability to pay.

Curated OER

Paying Taxes for Chores Lesson

Young scholars examine the concept of paying taxes with a chores theme.

Curated OER

Circular Flows

To study circular flow, learners use the plans to trace through a series of interconnected economic and financial flows to explain the workings of the American economy. They use the model developed to comprehend the effects of Federal...

College Board

2000 AP® Macroeconomics Free-Response Questions

When a country faces a recession, the government has various options: decrease taxes to stimulate consumer spending or increase taxes to fund projects. Which works best? Young economists ponder this question, along with how an increase...

Curated OER

Regressive Taxes

Learners explain that regressive taxes can have different effects on different income groups. They see how a regressive tax takes a larger share of income from low-income groups than from high-income groups.

Curated OER

Taxes: Where Does Your Money Go?

Students study taxes and the role that they place in our lives. In this economic lesson plan, students explore the reality of taxes, how they work, why we pay them, where the money goes and how to make the most of the money you pay into...

Curated OER

Financial Literacy - Income and Deductions

Students examine payroll process, determining ones income, deductions taken out of paychecks (taxes, insurance, charitable contributions, retirement), fixed and variable expenses to expect and money management.

Curated OER

Module 8-Tax Credit for Child and Dependent Care Expenses

Students explain the tax credit for child and dependent care expenses. They distinguish between a tax deduction and a tax credit. They see how the tax credit for child and dependent care expenses affects the tax liability.

Curated OER

Dependents and Tax Credits

Students identify "count" and "non-count" nouns, and examine and discuss the Earned Income Tax Credit. They define key vocabulary words, complete various worksheets, read a newspaper article, and answer discussion questions.

Texas Education Agency (TEA)

Importance of Being Accurate

Accuracy is key! Using the detailed resource, scholars practice their presicion skills, taking online spelling and typing tests. Next, they demonstrate accuracy by calculating the gross and net pay of five hypothetical employees.

Curated OER

Your First Job

Students determine that they are responsible for paying income taxes through withholdings on earned income. They examine the Form W-4.

Curated OER

Income Statement

Students demonstrate the proper way to prepare an income statement. They calculate a company's Gross Profit, Operating Expenses, Income from Operation before tax and Net Income, then determine the company's net income or net loss during...

Curated OER

Earned Income Credit

Learners distinguish between tax deduction and tax credit, explain how the earned income credit affects the tax liability, apply requirements to claim the earned income credit, and describe factors that determine the amount of the earned...

Curated OER

Contemporary Changes in the Distribution of Income and Wealth

In this Contemporary Changes learning exercise, students look at a table (not provided) to answer questions about incomes of wage earners, then complete a graphic organizer about wealthy versus non-wealthy people.

Curated OER

The Politics Of Taxation

Students explain that taxation involves a compromise of conflicting goals and that lobbyists can influence lawmakers' decisions about taxes. They can explain why people of similar incomes often pay different tax rates and work in teams...

Curated OER

Stone Fox

Students use the book, Stone Fox, to explore income, capital, saving, taxes, and credit. Stone Fox tells the story of Little Willy, a ten year old who enters a challenging dog-sled race in hopes of winning money to pay the back taxes on...

Curated OER

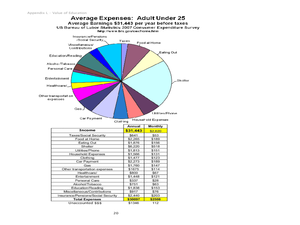

Value of Education: Education and Earning Power

Students explore the earning power of someone with a post-high school education. In this education and income lesson, students evaluate examples of occupations, their salaries, and education level needed for the job. Students calculate...

Other popular searches

- Income Tax Form 1040ez

- Income Tax Return

- Income Tax Forms

- Federal Income Tax

- Income Tax Preparation

- Filing Income Taxes

- Income Tax Form 1040ex

- Income Tax Form 1040az

- Income Taxes 1040ez

- Earned Income Tax Credit

- Income Tax Deductions

- Income Taxes Teachers Lesson